The Religious Liberty and Charitable Donation Protection Act (RLCDPA) of 1998 clarified the degree to which an individual can contribute to charities in the year prior to filing for bankruptcy.

Donation law ensured First Amendment religious freedom was protected

The law was intended in part to ensure individuals’ right to freely exercise their religious faith by giving to their church free from excessive governmental interference.

Law clarified how individuals can contribute to charities prior to bankruptcy filing

In a number of legal cases, lower courts had questioned such expenditures — often regarded by contributors as tithes and therefore essential to the exercise of their religious faith — and in a few cases had tried to retrieve charitable contributions that had been given to religious organizations. Even after the adoption of the Religious Freedom Restoration Act of 1993, it was not always clear how compelling the interests of contributors were in such cases.

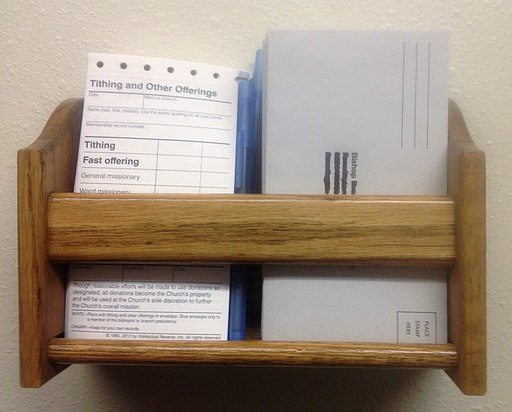

The law allows such contributions up to 15 percent of gross annual income in cases in which there has been no attempt to defraud creditors and donations are consistent with prior practice.

Law achieves First Amendment religious neutrality

The law achieves a degree of neutrality by applying not simply to contributions to religious entities but to all charitable organizations. Debate continues as to whether the contributions of up to 15 percent are automatically exempt or whether they are also subject to judicial investigation of their “reasonableness.”

John Vile is a professor of political science and dean of the Honors College at Middle Tennessee State University. He is co-editor of the Encyclopedia of the First Amendment. This article was originally published in 2009.